Arbitrage betting involves placing large bets to maximize your profits. While many bookmakers will automatically accept small stakes, larger stakes will require them to review your bets. In this case, you will not know if your leg was accepted before it's too late.

Arbitrage betting is a sign up bonus

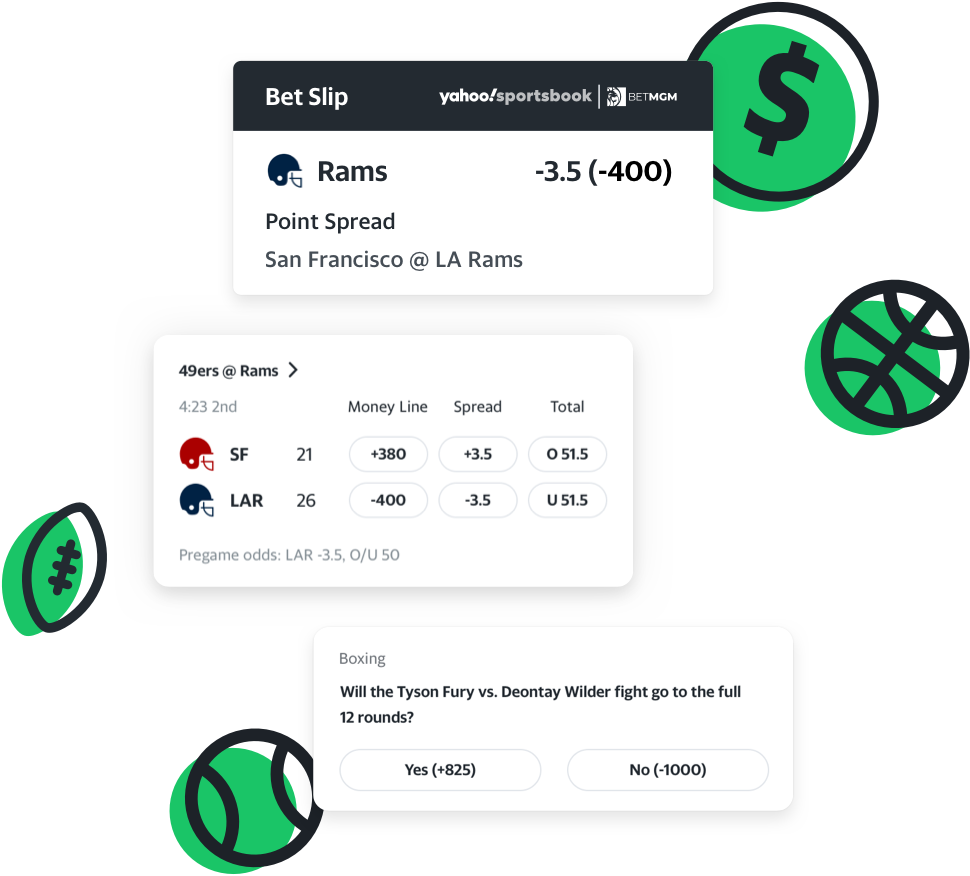

Arbitrage betting involves betting on sporting events using odds. This strategy differs to the traditional "buy high, sell low" strategy. It relies on statistics and takes advantage these discrepancies for winning bets. This strategy is not without its problems. Despite these challenges, this strategy can be used to help iGaming operators fight fraud and keep legitimate players happy.

It is a strategy for betting.

Arbitrage betting allows you to take advantage of fluctuations in the price of a betting market. You place bets on different outcomes of the same event such as a race, or a soccer match. As long as the stakes are equal for each event you will make a profit. This strategy is extremely popular in the world of betting because it gives you a secure profit.

It is not an analytical approach

Arbitrage betting is when you place a wager on two outcomes simultaneously. It is a way to ensure that there is a sufficient difference in the odds of both outcomes. Although it's often used in gambling terms, this is not gambling.

It involves large wagers

Arbitrage betting involves placing large stakes on many sporting events. This includes horse racing, football, and horse racing. Arbitrage betting can bring in large profits and small losses because of the high stakes. Signing up for a bonus at a bookmaker is a great way of getting started in arbitrage. It's important to remember that odds can change at any moment.

It's prone to making mistakes

Arbitrage betting can be a great way of increasing your betting profits. However, there are some drawbacks. No matter how many bets you are placing, there are always risks that could lead to disaster. You could make an error by placing the wrong stake, or "leg", in the arb. Another mistake is placing a bet before all the arbitrage bettors are ready.

FAQ

How much debt can you take on?

It is important to remember that too much money can be dangerous. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. So when you find yourself running low on funds, make sure you cut back on spending.

But how much should you live with? There's no right or wrong number, but it is recommended that you live within 10% of your income. Even after years of saving, this will ensure you won't go broke.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. You shouldn't spend more that $2,000 monthly if your income is $20,000 If you earn $50,000, you should not spend more than $5,000 per calendar month.

It's important to pay off any debts as soon and as quickly as you can. This includes student loans and credit card bills. When these are paid off you'll have money left to save.

It's best to think about whether you are going to invest any of the surplus income. If you choose to invest your money in bonds or stocks, you may lose it if the stock exchange falls. However, if the money is put into savings accounts, it will compound over time.

For example, let's say you set aside $100 weekly for savings. Over five years, that would add up to $500. You'd have $1,000 saved by the end of six year. You would have $3,000 in your bank account within eight years. By the time you reach ten years, you'd have nearly $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. It's impressive. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. You'd have more than $57,000 instead of $40,000

It is important to know how to manage your money effectively. If you don't, you could end up with much more money that you had planned.

How do wealthy people earn passive income through investing?

There are two ways you can make money online. The first is to create great products or services that people love and will pay for. This is what we call "earning money".

The second way is to find a way to provide value to others without spending time creating products. This is called "passive" income.

Let's assume you are the CEO of an app company. Your job is to create apps. You decide to make them available for free, instead of selling them to users. Because you don't rely on paying customers, this is a great business model. Instead, you rely on advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how internet entrepreneurs who are successful today make their money. They are more focused on providing value than creating stuff.

What is the difference between passive income and active income?

Passive income means that you can make money with little effort. Active income requires hardwork and effort.

Active income is when you create value for someone else. If you provide a service or product that someone is interested in, you can earn money. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income allows you to be more productive while making money. Most people don't want to work for themselves. So they choose to invest time and energy into earning passive income.

The problem with passive income is that it doesn't last forever. If you hold off too long in generating passive income, you may run out of cash.

You also run the risk of burning out if you spend too much time trying to generate passive income. It is best to get started right away. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate - These include buying land, flipping houses and investing in real estate.

Which side hustles are most lucrative?

Side hustles are income streams that add to your primary source of income.

Side hustles are important because they make it possible to earn extra money for fun activities as well as bills.

In addition, side hustles also help you save more money for retirement, give you time flexibility, and may even increase your earning potential.

There are two types of side hustles: passive and active. Online businesses, such as blogs, ecommerce stores and freelancing, are passive side hustles. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles that work for you are easy to manage and make sense. If you love working out, consider starting a fitness business. Consider becoming a freelance landscaper, if you like spending time outdoors.

There are many side hustles that you can do. Look for opportunities where you already spend time -- whether it's volunteering or taking classes.

For example, if you have experience in graphic design, why not open your own graphic design studio? Perhaps you are a skilled writer, why not open your own graphic design studio?

Be sure to research thoroughly before you start any side hustle. If the opportunity arises, this will allow you to be prepared to seize it.

Remember, side hustles aren't just about making money. They can help you build wealth and create freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

Which side hustles are the most lucrative in 2022

The best way today to make money is to create value in the lives of others. This will bring you the most money if done well.

You may not realize it now, but you've been creating value since day 1. You sucked your mommy’s breast milk as a baby and she gave life to you. You made your life easier by learning to walk.

If you keep giving value to others, you will continue making more. In fact, the more value you give, then the more you will get.

Value creation is a powerful force that everyone uses every day without even knowing it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

Today, Earth is home for nearly 7 million people. Each person is creating an amazing amount of value every day. Even if your hourly value is $1, you could create $7 million annually.

This means that you would earn $700,000.000 more a year if you could find ten different ways to add $100 each week to someone's lives. This is a lot more than what you earn working full-time.

Let's suppose you wanted to increase that number by doubling it. Let's imagine you could find 20 ways of adding $200 per month to someone's lives. Not only would this increase your annual income by $14.4 million, but it also makes you extremely rich.

There are millions of opportunities to create value every single day. This includes selling products, services, ideas, and information.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. Helping others to achieve their goals is the ultimate goal.

If you want to get ahead, then focus on creating value. You can get my free guide, "How to Create Value and Get Paid" here.

What is the easiest way to make passive income?

There are many options for making money online. Some of these take more time and effort that you might realize. How can you make extra cash easily?

The solution is to find what you enjoy, blogging, writing or selling. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. Start a blog where you share helpful information on topics related to your niche. You can then sign up your readers for email or social media by inviting them to click on the links contained in your articles.

This is known as affiliate marketing and you can find many resources to help get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

A blog could be another way to make passive income. This time, you'll need a topic to teach about. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

There are many ways to make money online, but the best ones are usually the simplest. You can make money online by building websites and blogs that offer useful information.

Once you have created your website, share it on social media such as Facebook and Twitter. This is content marketing. It's an excellent way to bring traffic back to your website.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

External Links

How To

How to Make Money Online

How to make money online today differs greatly from how people made money 10 years ago. The way you invest your money is also changing. There are many ways to earn passive income, but most require a lot of upfront investment. Some methods are simpler than others. Before you start investing your hard-earned money in any endeavor, you must consider these important points.

-

Find out what kind of investor you are. PTC sites (Pay Per Click) are great for those who want to quickly make a quick buck. They pay you to simply click ads. Affiliate marketing is a better option if you are more interested in long-term earnings potential.

-

Do your research. Do your research before you sign up for any program. Review, testimonials and past performance records are all good places to start. It is not worth wasting your time and effort only to find out that the product does not work.

-

Start small. Don't just jump right into one big project. Instead, build something small first. This will help you learn the ropes and determine whether this type of business is right for you. You can expand your efforts to larger projects once you feel confident.

-

Get started now! You don't have to wait too long to start making money online. Even if it's been years since you last worked full-time, you still have enough time to build a solid portfolio niche websites. All you need to get started is an idea and some hard work. Take action now!