Paddy Power is an Irish gaming company with its headquarters located in Dublin. Its operations also take place from Malta, which is its hub. The company offers both online and sports betting. Customers also get loyalty rewards from the company. Paddy Power provides loyalty rewards as well as customer service. This article will provide information about Paddy Power's payment options.

Customer service

Paddy Power provides reliable and prompt customer service. Its customer service team is well-informed and aims to solve any problem within thirty minutes. You can also email the site for support. Usually, you will receive a response within half an hour. This is the reason Paddy Power is so successful.

Paddy Power is a popular Irish bookmaker that serves customers throughout the UK and Ireland. It has an extensive online presence and betting shops in most major cities in the country. You can also place your bet over the phone.

Online Gambling Restrictions

Paddy Power's restrictions on online gaming aren't just for Paddy Power. Following the COVID-19 epidemic, Sweden and the UK have implemented even stricter guidelines. These restrictions are designed to stop online gambling sites from targeting vulnerable groups. These restrictions are also designed to protect young people from gambling culture influence.

The new rules allow players to only wager with a specific amount at a given time. Players must be aware about the risks associated with gambling, including the possibility that they will lose money. New regulations will restrict the amount of money players can wager with bonuses. They are effective from June 1, and will last until the end.

Payment methods are subject to limitations

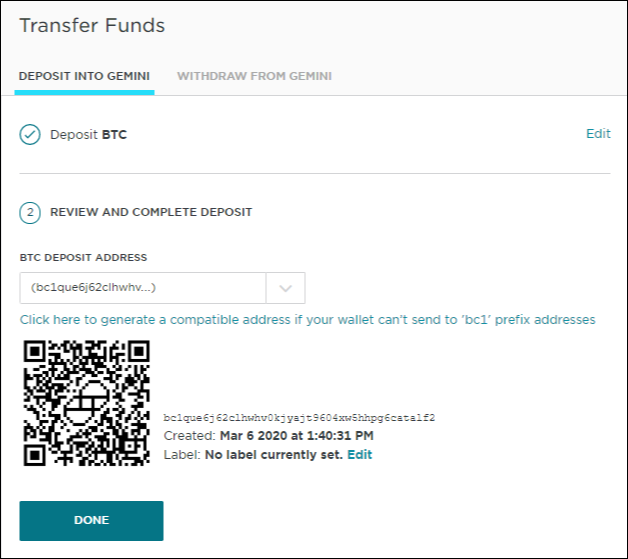

Paddy Power, an online bookmaker, accepts many payment methods including credit and debit cards. It also accepts Apple Pay and Google Pay. However, some payment methods have restrictions so make sure to check the site before you deposit. You can't deposit more than PS5 with a credit card, but you can use Apple Pay if you need to deposit less than that amount.

Neteller is another method of payment that Paddy Power accepts. It is a digital money transfer company. However, you will need to have a Neteller account and this account is not open to everyone. Neteller is a secure method of payment that allows you deposit and withdraw funds in minutes. However, this method comes with some limitations. You can only deposit EUR5 and wait five days for your withdrawals.

FAQ

How to create a passive income stream

To make consistent earnings from one source you must first understand why people purchase what they do.

It is important to understand people's needs and wants. Learn how to connect with people to make them feel valued and be able to sell to them.

The next step is to learn how to convert leads in to sales. Finally, you must master customer service so you can retain happy clients.

This is something you may not realize, but every product or service needs a buyer. If you know the buyer, you can build your entire business around him/her.

To become a millionaire it takes a lot. You will need to put in even more effort to become a millionaire. Why? You must first become a thousandaire in order to be a millionaire.

Then, you will need to become millionaire. The final step is to become a millionaire. You can also become a billionaire.

How can someone become a billionaire. Well, it starts with being a thousandaire. You only need to begin making money in order to reach this goal.

But before you can begin earning money, you have to get started. Let's take a look at how we can get started.

Which side hustles are the most lucrative in 2022

The best way to make money today is to create value for someone else. If you do it well, the money will follow.

Although you may not be aware of it, you have been creating value from day one. Your mommy gave you life when you were a baby. You made your life easier by learning to walk.

Giving value to your friends and family will help you make more. Actually, the more that you give, the greater the rewards.

Everyone uses value creation every day, even though they don't know it. You're creating value all day long, whether you're making dinner for your family or taking your children to school.

In fact, there are nearly 7 billion people on Earth right now. Each person is creating an amazing amount of value every day. Even if only one hour is spent creating value, you can create $7 million per year.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. That's a huge increase in your earning potential than what you get from working full-time.

Let's imagine you wanted to make that number double. Let's suppose you find 20 ways to increase $200 each month in someone's life. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

There are millions of opportunities to create value every single day. This includes selling information, products and services.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. Helping others to achieve their goals is the ultimate goal.

Create value to make it easier for yourself and others. You can get my free guide, "How to Create Value and Get Paid" here.

What is personal finance?

Personal finance involves managing your money to meet your goals at work or home. It is about understanding your finances, knowing your budget, and balancing your desires against your needs.

By mastering these skills, you'll become financially independent, which means you don't depend on anyone else to provide for you. You won't have to worry about paying rent, utilities or other bills each month.

It's not enough to learn how money management can help you make more money. It makes you happier. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

What does personal finance matter to you? Everyone does! Personal finance is one the most sought-after topics on the Internet. According to Google Trends, searches for "personal finance" increased by 1,600% between 2004 and 2014.

Today, people use their smartphones to track budgets, compare prices, and build wealth. You can find blogs about investing here, as well as videos and podcasts about personal finance.

In fact, according to Bankrate.com, Americans spend an average of four hours a day watching TV, listening to music, playing video games, surfing the Web, reading books, and talking with friends. That leaves only two hours a day to do everything else that matters.

When you master personal finance, you'll be able to take advantage of that time.

What is the difference between passive income and active income?

Passive income means that you can make money with little effort. Active income is earned through hard work and effort.

When you make value for others, that is called active income. Earn money by providing a service or product to someone. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income allows you to be more productive while making money. Most people aren’t keen to work for themselves. Therefore, they opt to earn passive income by putting their efforts and time into it.

The problem is that passive income doesn't last forever. If you wait too long to generate passive income, you might run out of money.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, It's better to get started now than later. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types passive income streams.

-

Businesses - these include owning a franchise, starting a blog, becoming a freelancer, and renting out the property such as real estate

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

What side hustles are the most profitable?

Side hustle is an industry term that refers to any additional income streams that supplement your main source.

Side hustles are important because they make it possible to earn extra money for fun activities as well as bills.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types side hustles: active and passive. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. Some examples of active side hustles include dog walking, tutoring and selling items on eBay.

Side hustles that work for you are easy to manage and make sense. Start a fitness company if you are passionate about working out. You might consider working as a freelance landscaper if you love spending time outdoors.

Side hustles can be found everywhere. Side hustles can be found anywhere.

Why not start your own graphic design company? Or perhaps you have skills in writing, so why not become a ghostwriter?

You should do extensive research and planning before you begin any side hustle. If the opportunity arises, this will allow you to be prepared to seize it.

Side hustles aren’t about making more money. They're about building wealth and creating freedom.

There are so many ways to make money these days, it's hard to not start one.

How much debt can you take on?

It's essential to keep in mind that there is such a thing as too much money. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. When you run out of money, reduce your spending.

But how much should you live with? While there is no one right answer, the general rule of thumb is to live within 10% your income. This will ensure that you don't go bankrupt even after years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. If you make $20,000, you should' t spend more than $2,000 per month. If you earn $50,000, you should not spend more than $5,000 per calendar month.

Paying off your debts quickly is the key. This applies to student loans, credit card bills, and car payments. Once those are paid off, you'll have extra money left over to save.

It's best to think about whether you are going to invest any of the surplus income. If you choose to invest your money in bonds or stocks, you may lose it if the stock exchange falls. But if you choose to put it into a savings account, you can expect interest to compound over time.

Let's take, for example, $100 per week that you have set aside to save. This would add up over five years to $500. After six years, you would have $1,000 saved. In eight years, your savings would be close to $3,000 When you turn ten, you will have almost $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. That's pretty impressive. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000, you'd now have more than $57,000.

It's crucial to learn how you can manage your finances effectively. Otherwise, you might wind up with far more money than you planned.

Statistics

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

External Links

How To

For cash flow improvement, passive income ideas

There are many ways to make money online, and you don't need to be hard working. Instead, you can make passive income at home.

There may be an existing business that could use automation. You might be thinking about starting your own business. Automating certain parts of your workflow may help you save time as well as increase productivity.

Your business will become more efficient the more it is automated. This will allow you to focus more on your business and less on running it.

Outsourcing tasks can be a great way to automate them. Outsourcing allows you to focus on what matters most when running your business. By outsourcing a task you effectively delegate it to another party.

This means that you can focus on the important aspects of your business while allowing someone else to manage the details. Because you don't have to worry so much about the details, outsourcing makes it easier for your business to grow.

Another option is to turn your hobby into a side hustle. It's possible to earn extra cash by using your skills and talents to develop a product or service that is available online.

Write articles, for example. There are many places where you can post your articles. These websites pay per article, allowing you to earn extra monthly cash.

It is possible to create videos. Many platforms let you upload videos directly to YouTube and Vimeo. When you upload these videos, you'll get traffic to both your website and social networks.

Investing in stocks and shares is another way to make money. Investing in shares and stocks is similar to investing real estate. However, instead of paying rent, you are paid dividends.

As part of your payout, shares you have purchased are given to shareholders. The amount of your dividend will depend on how much stock is purchased.

You can sell shares later and reinvest the profits into more shares. This way you'll continue to be paid dividends.