Learning how to read odds is key to making smart and profitable bets on sports. There are three types of odds for sports: American odds, decimal odds and fractional odds. These odds will tell you how much money you can win or lose as well as the probability of the outcome. When choosing which odds to bet on, make sure to look for the ones that have the highest value. You should remember, however, that sports betting results can be affected by many factors and it is not advisable to rely solely on odds.

Decimal odds

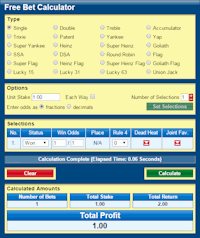

While decimal odds may be familiar to you, there are still some things that you might not understand. If you don’t know what decimal odds are, it can be difficult for you to make a betting decision on a certain sport. It's much easier to comprehend than fractions. If you're still confused, here's a handy decimal odds calculator.

In most sports betting situations, you'll find decimal odds on point spreads or totals. For example, 1.13 is the odds that the Chiefs will be the heavy favorite. On the other hand, the Steelers have a 6.50 moneyline. As you can see, the odds on these teams are similar but are still significantly different.

American odds

If you are a football fan, you may have heard of American sports odds. These are the odds that a game will be played. They are also used for sports betting. The odds for different kinds of games depend on the market, so they can change at any time. It is important to understand the American sports odds and how they work.

You can view the odds by looking at either positive or negative numbers. The negative number denotes the team in favor, while the positive number denotes the underdog. Spreads are the most popular form of betting. They even out the playing field between two teams.

Moneyline odds

There are many ways you can bet on sport. Understanding how sports moneyline odds works is key to predicting the winner. Moneyline odds are determined by computing implied probabilities. If a team is considered a favorite to win, then the moneyline odds are higher. The moneyline odds of an underdog team are lower.

The moneyline odds take into account the matchups of the team, in addition to the implied probabilities. For example, a team that is favored to win may struggle to contain a pass-catching running back. An opposing team might have a strong offensive line and struggle to stop a powerful guard. These considerations also apply to hockey and baseball.

FAQ

Which side hustles are most lucrative?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles can also be a great way to save money for retirement, have more time flexibility, or increase your earning potential.

There are two types. Online businesses like e-commerce, blogging, and freelance work are all passive side hustles. Some examples of active side hustles include dog walking, tutoring and selling items on eBay.

Side hustles are smart and can fit into your life. A fitness business is a great option if you enjoy working out. Consider becoming a freelance landscaper, if you like spending time outdoors.

Side hustles can be found everywhere. Find side hustle opportunities wherever you are already spending your time, whether that's volunteering or learning.

If you are an expert in graphic design, why don't you open your own graphic design business? Perhaps you are a skilled writer, why not open your own graphic design studio?

Do your research before starting any side-business. So when an opportunity presents itself, you will be prepared to take it.

Remember, side hustles aren't just about making money. Side hustles can be about creating wealth or freedom.

With so many options to make money, there is no reason to stop starting one.

What is the difference between passive income and active income?

Passive income means that you can make money with little effort. Active income is earned through hard work and effort.

If you are able to create value for somebody else, then that's called active income. If you provide a service or product that someone is interested in, you can earn money. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income is great as it allows you more time to do important things while still making money. But most people aren't interested in working for themselves. They choose to make passive income and invest their time and energy.

The problem is that passive income doesn't last forever. If you hold off too long in generating passive income, you may run out of cash.

If you spend too long trying to make passive income, you run the risk that your efforts will burn out. It's better to get started now than later. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are three types to passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

Is there a way to make quick money with a side hustle?

To make money quickly, you must do more than just create a product/service that solves a problem.

Also, you need to figure out a way that will position yourself as an authority on any niche you choose. It means building a name online and offline.

Helping others solve their problems is a great way to build a name. So you need to ask yourself how you can contribute value to the community.

After answering that question, it's easy to identify the areas in which you are most qualified to work. There are many ways to make money online.

When you really look, you will notice two main side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

Each approach has its pros and cons. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. Additionally, there is intense competition for these types of gigs.

Consulting allows you to grow and manage your business without the need to ship products or provide services. However, it takes time to become an expert on your subject.

In order to succeed at either option, you need to learn how to identify the right clientele. This takes some trial and errors. But in the long run, it pays off big time.

What are the top side hustles that will make you money in 2022

The best way today to make money is to create value in the lives of others. If you do it well, the money will follow.

It may seem strange, but your creations of value have been going on since the day you were born. As a baby, your mother gave you life. Learning to walk gave you a better life.

If you keep giving value to others, you will continue making more. You'll actually get more if you give more.

Value creation is a powerful force that everyone uses every day without even knowing it. You are creating value whether you cook dinner, drive your kids to school, take out the trash, or just pay the bills.

In fact, there are nearly 7 billion people on Earth right now. That's almost 7 billion people on Earth right now. This means that each person creates a remarkable amount of value every single day. Even if your hourly value is $1, you could create $7 million annually.

If you could find ten more ways to make someone's week better, that's $700,000. Think about that - you would be earning far more than you currently do working full-time.

Now let's pretend you wanted that to be doubled. Let's suppose you find 20 ways to increase $200 each month in someone's life. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

There are millions of opportunities to create value every single day. Selling products, services and ideas is one example.

Even though we spend much of our time focused on jobs, careers, and income streams, these are merely tools that help us accomplish our goals. Helping others to achieve their goals is the ultimate goal.

Create value to make it easier for yourself and others. You can get my free guide, "How to Create Value and Get Paid" here.

How much debt can you take on?

It is vital to realize that you can never have too much money. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. So when you find yourself running low on funds, make sure you cut back on spending.

But how much do you consider too much? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. You'll never go broke, even after years and years of saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. If you make $20,000, you should' t spend more than $2,000 per month. Spend no more than $5,000 a month if you have $50,000.

Paying off your debts quickly is the key. This includes student loans, credit cards, car payments, and student loans. After these debts are paid, you will have more money to save.

It is best to consider whether or not you wish to invest any excess income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. However, if you put your money into a savings account you can expect to see interest compound over time.

Let's take, for example, $100 per week that you have set aside to save. It would add up towards $500 over five-years. At the end of six years, you'd have $1,000 saved. In eight years, you'd have nearly $3,000 in the bank. In ten years you would have $13,000 in savings.

Your savings account will be nearly $40,000 by the end 15 years. This is quite remarkable. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000, you'd now have more than $57,000.

It's crucial to learn how you can manage your finances effectively. If you don't, you could end up with much more money that you had planned.

Why is personal financial planning important?

Personal financial management is an essential skill for anyone who wants to succeed. Our world is characterized by tight budgets and difficult decisions about how to spend it.

Why then do we keep putting off saving money. Is there anything better to spend our energy and time on?

Yes and no. Yes, because most people feel guilty if they save money. Because the more money you earn the greater the opportunities to invest.

Spending your money wisely will be possible as long as you remain focused on the larger picture.

It is important to learn how to control your emotions if you want to become financially successful. You won't be able to see the positive aspects of your situation and will have no support from others.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This is because you aren't able to manage your finances effectively.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the act of setting aside a portion of your income each month towards future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

External Links

How To

For cash flow improvement, passive income ideas

You don't have to work hard to make money online. There are many ways to earn passive income online.

There may be an existing business that could use automation. If you are considering starting your own business, automating parts can help you save money and increase productivity.

Automating your business is a great way to increase its efficiency. This allows you more time to grow your business, rather than run it.

A great way to automate tasks is to outsource them. Outsourcing allows you to focus on what matters most when running your business. By outsourcing a task you effectively delegate it to another party.

This means that you can focus on the important aspects of your business while allowing someone else to manage the details. Outsourcing can make it easier to grow your company because you won’t have to worry too much about the small things.

You can also turn your hobby into an income stream by starting a side business. Using your skills and talents to create a product or service that can be sold online is another way to generate extra cash flow.

For example, if you enjoy writing, why not write articles? You have many options for publishing your articles. These websites offer a way to make extra money by publishing articles.

It is possible to create videos. Many platforms allow you to upload videos to YouTube or Vimeo. You'll receive traffic to your website and social media pages when you post these videos.

Stocks and shares are another way to make some money. Investing is similar as investing in real property. Instead of receiving rent, dividends are earned.

These shares are part of your dividend when you purchase shares. The amount of dividend you receive depends on the stock you have.

You can sell shares later and reinvest the profits into more shares. This will ensure that you continue to receive dividends.